Seeking voter approval of a new operating tax levy of some yet-to-be-determined amount, may be a solution they would want to consider, said the district’s treasurer.

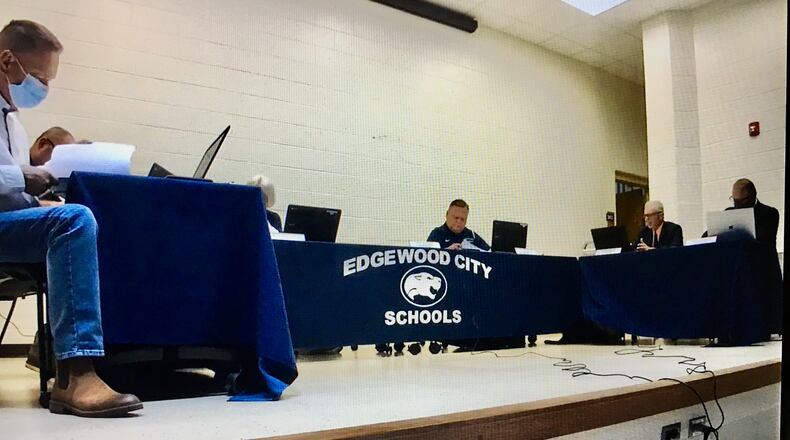

But Treasurer Randy Stiver stressed no board decision needs to be made immediately and that his five-year projection – which is required of all Ohio districts each October and May – “was an informational type of thing.”

Board member Tom York said after listening to Stiver during the board’s work session meeting: “We need to continue having a conversation around this” because the district’s looming budgetary shortfall will begin in 2023.

“It’s not a matter of if but when,” York said of the prospect of asking local residents in the future to approve some form of a school tax increase.

In April of 2020, Edgewood voters took advantage of a rare, substitution tax levy – which lowered the overall school tax rate for residents – by approving a new school tax by 56% to 44%.

But Stiver, said the district’s federal funding to offset the financial impacts of the coronavirus pandemic will begin to run out toward the end of the five-year projection and will have to be replaced with another source of money.

“Starting in 2023 and 2024 you start to see that (federal aid) disappear. That bucket of money goes away and I have to bring those (expenditures) back into our general fund,” he said.

Stiver said next year’s Ohio election calendar allows school districts to put tax issues on the ballot on May 3, Aug. 2 and Nov. 8 and that the deadline for putting any proposed tax issue on the May ballot requires board approval by Feb. 2.

The board took no action during its work session with members saying more discussions need to occur before the board would consider starting the two-resolution vote approval process required by state law to place a proposed tax hike on the ballot.

Delaying beyond 2022 to seek a new operating levy, said York, will have consequences.

“Waiting will make the (tax) mileage go up,” he said.

About the Author