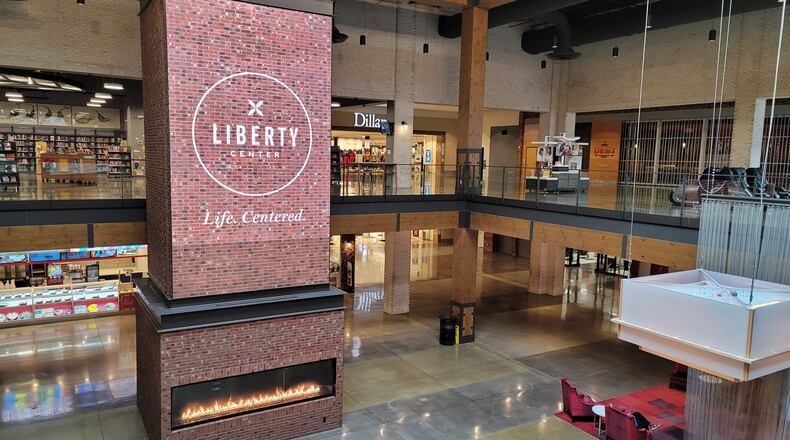

The owners of the mega mixed use development had their hearing with the BOR Thursday and a decision will be made in about two weeks, according to Mike Gildea, an appraiser with the Butler County Auditor’s Office.

“Senate Bill 57 allows for entities like Liberty Center to file complaints (about property values) due to loss of rental income due to COVID,” told the Journal-News previously.

The BOR is comprised of representatives from the auditor, commissioners and treasurer’s offices. David Fehr, the county’s development director represents the commissioners on the BOR. He said he just received new appraisal information from Liberty Center Thursday so they will be meeting again Nov. 4, after the board has time to review the new information.

Dillards, which is within the mall but owned separately, had requested a $3.75 million value reduction to $9 million. The BOR on Thursday voted to retain the auditor’s $12.7 million value.

Dillard’s application states, “the shift to online retail during the pandemic has diminished the value of the property” and a handwritten notation states sales have diminished 32%. Gildea said Dillard’s didn’t provide any evidence to back this up.

He said they have had seven hearings so far and hoped to wrap them all up this week. The outcome of six that have been decided is three had their value reduced, the property value on two hotels in West Chester remained unchanged and one applicant withdrew.

Another form of COVID relief, the federal forgivable loan paycheck protection program, has come into play during these hearings. The bulk of the COVID property value reduction applications came from hotels that were virtually shuttered during the height of the pandemic when stay at home orders were issued.

“Obviously hotels were hurt during COVID due to the lack of occupancy but what we’re finding is many of those entities received the PPP forgivable loans from the federal government...,” Gildea said. “How do you deal with reducing the property value when they’ve received federal CARES money.”

The Hampton Inn on Tylers Place Boulevard asked for a $2.2 million value reduction and according to the federal PPP database received a $199,941 payroll loan. The Homewood Suites on Schulze Drive requested a $2.1 million value decrease and apparently received a $236,028 forgivable loan.

Gildea said in those instances “we’re retaining the auditor’s value and shipping them off to the Board of Tax Appeals for future guidance, we just don’t know, we’re definitely in uncharted territories.”

Attorney Chris Finney’s office represented both hotels in this process but said he couldn’t comment.

However, Dr. Mohamed Aziz, who owns a drug rehab center in West Chester Twp. — he sued the township in 2016 in federal court over its efforts to block his business — received the largest value reduction at $917,200. The PPP database shows his Professional Psychiatric Services business received $256,804 allocation.

Gildea said Professional Psychiatric Services was under renovation when COVID hit so the project couldn’t be completed. The PPP award wasn’t discussed during BOR hearing. He said the property which is now valued at $2.5 million will be revisited in 2023 to see if the value should be adjusted.

Laura Sheehan, who is listed as the contact for PPS said they had no comment on the reduced value.

The other properties that received a break were the Frisch’s Big Boy in Hamilton and a vacant medical office complex in Middletown at $308,172 and $43,840 respectively.

County Treasurer Nancy Nix said it is surprising more businesses hurt by the pandemic didn’t request value reductions.

“I don’t think we knew what to expect,” Nix said. “Would there be hundred, would there be 5, so I think we dodged a bullet a little bit because there were only 20.”

The BOR received 773 challenges to the 2020 revaluation which was separate from the COVID requests. In that batch the board agreed to a $14 million Liberty Center value reduction, bringing the value of the retail portion of the development down to $124 million. Gildea said Liberty Center owners have appealed the reduction to the state tax appeals board, they wanted a $58 million value drop to $80 million.

About the Author