This prevents employers from losing workers they will need in the future, when business picks up.

Coronavirus: Complete Coverage by the Dayton Daily News

The program keeps Ohio workers employed, while also making up some lost pay through unemployment compensation payments.

“The SharedWork Ohio program can help to fill the gap between those lost hours and their normal paycheck amount,” said Michael Zimmerman, spokesman with Montgomery County Business Services, which promotes the program through the regional BusinessFirst! organization.

More than 32,000 employees across the state are participating in the program who would have otherwise been laid off, according to state data.

The program is especially attractive right now during the COVID-19 crisis, when participating employees can earn an extra $600 per week on top of their wages and prorated unemployment compensation.

“Employers don’t know about the program,” said Juliane Barone, legal chief with the legal support section in the Office of Unemployment Insurance Operations at the Ohio Department of Job and Family Services. “This is a nationwide issue.”

“It’s all about spreading the word to help people, in any way we can,” she said.

MORE: Homeownership up in Ohio. But will it last after the pandemic?

SharedWork Ohio is what is known as a work-share or short-time compensation program.

Employers who have reduced work needs can participate in these voluntary programs to retain employees who otherwise would be laid off while also cutting costs.

Participating businesses reduce workers’ hours between 10% to 50%, but continue paying wages and, if they provide them, benefits like health insurance and retirement.

The state then pays partial jobless benefits equal to the amount of the reduction in hours, between 10% to 50% of what workers would receive if they were fully unemployed.

“The employer reduces the risk of losing an employee through layoff and the employee gets to keep his or her job and still obtains limited unemployment comp benefits to supplement the loss of income from reduced hours caused by a lack of available work,” said Robert T. Dunlevey Jr., senior counsel with the Dayton office of Taft, Stettinius and Hollister.

“It’s a win-win,” said Dunlevey.

Coronavirus: Confused about unemployment? We answer your questions.

SharedWork Ohio’s use has skyrocketed during this pandemic, as businesses have seen demand, sales and foot traffic nosedive.

On March 15, SharedWork Ohio had 67 employer work-share plans. This week, there were 1,028 employer plans, which is up 1,434% from mid-March.

Employers can have multiple plans with different groups of employees, with different levels of reduced hours and pay.

About 618 employers are using SharedWork Ohio, with 32,571 participating employees. About 156 plans are pending, with 3,479 participating employees.

“This mini-explosion demonstrates that shared work could be a valuable tool for employers of all kinds,” said Zach Schiller, Policy Matters Ohio research director in a statement. “Moreover, it can also be used by employers to bring workers back to work.”

MORE: Dayton, Trotwood lagging in 2020 Census response

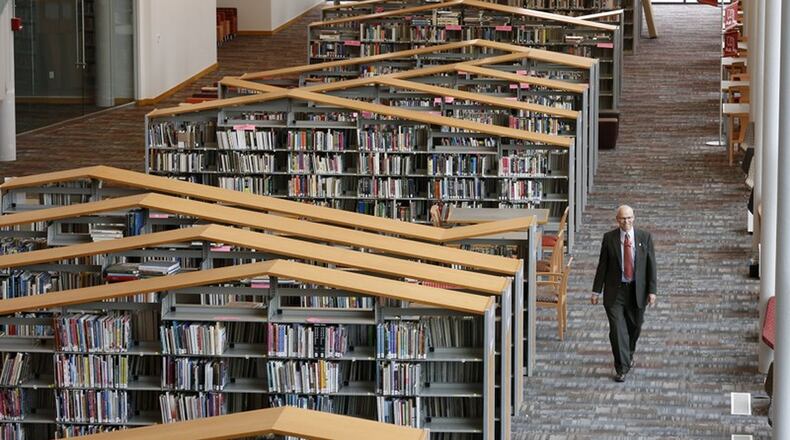

The Dayton Metro Library furloughed 311 employees for 50% of their hours through the SharedWork Ohio program, said Tim Kambitsch, the executive director of the Dayton Metro Library.

The library in mid-March suspended operations due to the public health emergency. In early June, the library will begin offering sidewalk and curbside pickup service, and the library expects to reintroduce other services soon, like computer and internet access.

“Due to the closures, opportunities to work dried up for most of (our) staff but the library knows it will need to bring them back soon,” Kambitsch said. “Keeping a connection with skilled and highly trained staff was an important priority.”

He added, “SharedWork Ohio allows the library to increase hours for employees as the need for work increases.”

Employers can utilize the work-share program to rehire employees who have been laid off, Barone said.

“Bring them back, put them on this plan, when things return to normal, they can return to normal status and hours,” Barone said. “Until then, keep them employed and work them between 10% to 50% of their normal weekly hours.”

SharedWork Ohio is probably best suited for employers that just need a little breathing room temporarily, as opposed to employers facing drastic financial difficulties and that are at serious risk of closure and need to make deep cuts, said Nadia Lampton, an attorney with Taft.

But during uncertain economic times like this, employers do not want to lose good employees when they are trying to keep their doors open and employees do not want to lose their source of income or be forced to search for a job in a time of high unemployment, she said.

“The program offers a mutual benefit to employers and employees both looking to ride out the storm,” she said.

The CARES Act, the third federal stimulus bill passed by Congress, created additional incentives for employers to use work-share programs, Barone said.

Lawmakers authorized enhanced unemployment benefits for laid-off workers during this public health emergency of $600 per week. Work-share participants are eligible for the full add-on payments.

“The SharedWork Ohio program keeps people on the rolls, it retains trained staff and, right now with the incentives, it’s a win-win,” Barone said.

Employees qualify for the work-share program if they are eligible for unemployment insurance.

Many employers pay for SharedWork Ohio benefits the same way they pay for regular unemployment benefits, through a quarterly tax. Some employers use a method where they reimburse the unemployment system dollar for dollar.

The state also plans to apply for federal grant through the CARES Act to help market and improve the program.

Ohio is expected to receive $2.3 million in federal support, and the state should use the money to widely promote the program, Schiller said.

“While it doesn’t fit every employer, it’s a proven way to reduce layoffs, and one that is especially worth considering now,” he said.

About the Author