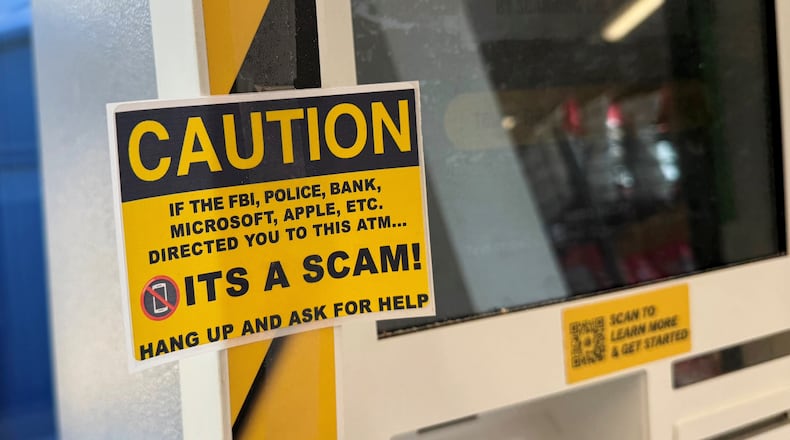

She was instructed to withdraw the cash, given a QR code and told to deposit the money into a Bitcoin or cryptocurrency ATM, which are found at convenience stores, gas stations, smoke shops and some smaller markets.

Transactions are irreversible.

Hundreds of cases

Geurin, 67, of Hamilton was a victim like hundreds of others so far this year in Ohio, claiming they’re from companies like Amazon, FedEd, a court system or the “federal government.” They’ve also targeted immigrants claiming to be immigration agents. A significant number of the victims are 60 years and older.

These emails, which often have typos, can be reported to email service providers as phishing or by contacting the actual company. For example, Paypal has an email to report phishing scams.

“They prey on greed, fear, lust and love,” said Butler County Assistant Prosecutor Garrett Baker. “Those are the big things, and unfortunately, when it’s elderly folks, they’ll tend to prey on the fear aspect, saying their account’s been compromised. Folks tend to get into panic mode, and it’s not until two or three days later that they start retracing their steps, thinking, maybe I shouldn’t have done this.”

Ohio ranks seventh in the number of internet complaints and 15th in the amount of losses, according to the FBI’s 2024 Internet Crime Center reports.

Those who are 60 years and older saw nearly $4.89 billion in losses in 2024, a 46% increase over 2023. Overall, the FBI received more than 859,500 complaints last year and more than 256,000 complaints had a loss that totaled more than $16.6 billion in losses, a 33% increase over 2023. Loss amounts have increased nationwide since 2018.

Reporting a scam quickly

Baker, the chief assistant prosecutor in the Butler County Prosecutor’s Economic Crime Division, said a legitimate company would not ask anybody to transact at a market, convenience store or smoke shop.

Though the transactions are irreversible, time is of the essence in recovering as much money as possible.

“How quickly somebody reports it is going to impact the likelihood of being able to get the money back,” Baker said. “The longer you wait, the more likely it is the funds will jump through wallets and potentially go through these things called mixers or tornado wallets, which allow the bad actors to obfuscate the origins of the funds.”

Once cash is deposited into what’s called a crypto wallet, a digital storage for cryptocurrency, it’s often transferred to additional wallets. If the cryptocurrency goes into a crypto mixer, it will obfuscate the origin and destination of the funds making it harder to track and link transactions.

Cryptocurrency ultimately goes into an exchange, where people can buy, sell and trade cryptocurrency. In order to withdraw the digital money as cash, it must be in an exchange.

Baker said, “It’s not an insignificant amount of money that’s flowing out of Ohio that’s just gone.”

Guerin got a little more than $5,200 returned. Another case involved a person being scammed out of $22,500 and the victim had nearly $18,900 returned. In 2024, around $200,000 was scammed from residents, according to the Butler Cunty Prosecutor’s Office.

Since January, the Bureau of Criminal Investigations from the Ohio Attorney General’s Office has investigated 200 cases, with scams ranging from $20,000 to an investment scam that cost the victim $6 million.

Ed Hunter, a special agent with BCI’s Special Investigation Unit, said the victim was part of an investment scam and kept pouring money based on what turned out to be falsified reports.

“Every case is different,” said Hunter. “The sooner the agency is made aware and they can be made aware and reach out to us, the quicker we can do the cryptocurrency tracing to see where that money went and what we can do.”

Advances in AI with scams

With the advances in AI, Hunter said people need to be careful with calls allegedly from loved ones.

“They’re using a lot of voice-generated messages from ‘loved ones’ saying, ‘This is so and so, and I’ve been in an accident and I need you to send X number of dollars,’” he said. “We encourage families to come up with a memory only that loved one would know, or a secret passcode only your family members could know, so you could know the validity of the phone message.”

Baker and Hunter said if someone tells you not to contact the authorities and pump money into a cryptocurrency ATM, it’s a scam and the police should be contacted immediately.

The big issue is that Ohio does not have laws limiting cryptocurrency transactions. While scams are happening across the country, not all states have cryptocurrency limits and laws, like Ohio. The state has held hearings on cryptocurrency legislation. Ohio Rep. Steve Demetriou, R-Bainbridge Twp., has been leading the effort.

“Digital assets are becoming an increasingly important part of the world’s economy,” he said during a February hearing of the Technology and Innovation House Committee, adding his bill “establishes essential safeguards to protect Ohio taxpayer dollars from abuse or mismanagement.”

U.S. Rep. Warren Davidson, R-Troy, has been working to establish some cryptocurrency and blockchain rules and regulations.

In April, Davidson, the chair of the House Financial Services Committee’s National Security Subcommittee, said the country needed to address the growing threat of investment fraud in the United States.

In March, the Federal Trade Commission reported that U.S. consumers lost $5.7 billion to investment scams in 2024.

“Criminals are increasingly finding ways to bypass U.S. financial regulations to scam Americans into draining their life savings for the sake of their own illicit gain,” he said. “This type of organized fraud transcends both state lines and political divides. These scammers prey on everyday Americans, often our most vulnerable senior citizens.”

About the Author