What should you look for next week when the bill is made public?

1. The big ticket items. Maybe the biggest flash point right now is what's known as SALT - the state and local tax deduction. It's estimated that about 30 percent of taxpayers who itemize their deductions use SALT, all around the country, though more often in the big city corridor from Boston to New York to Washington, D.C. A number of GOP lawmakers from New York and New Jersey have made it clear they will not vote for a tax reform bill that does away with the state and local tax deduction - and there are almost enough of them to scuttle a GOP tax bill immediately. But remember, taxpayers in every state use the SALT deduction - Texas is a good example of where it's an issue for the GOP. Republicans have been working on a deal to possibly limit the deduction instead. Along with the home mortgage interest deduction, SALT is seen by some as a political third rail.

2. Other popular deductions could go. If you look at IRS Schedule A, you quickly see it's about a lot more than just state and local taxes. If the GOP is really going to offer a tax reform plan that has dramatically lower rates and fewer deductions, then a lot of these have to go. Medical and Dental expenses. Gifts to charity, investment interest, casualty and theft losses, unreimbursed job expenses, tax preparation fees, gambling losses, and more. Remember, if it is true tax reform that gets rid of deductions, loopholes, tax breaks and carve-outs - and you want true simplification - this is one place to start. But it would certainly create some controversy; those deductions are there because a lot of people already take advantage of them.

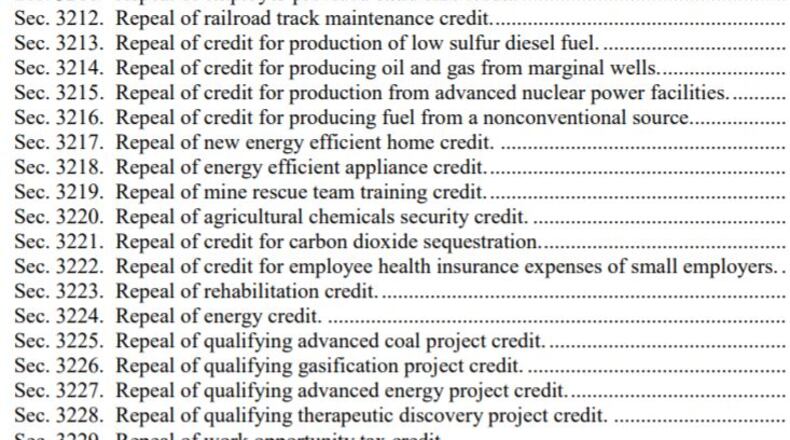

3. But wait, there's more. It's so easy to talk about tax reform - almost everyone is for the concept of tax reform - but few lawmakers ever follow up with a real bill to achieve it. Three years ago, former Congressman Dave Camp (R-MI) unveiled a full tax reform bill, which might give us some clues as to what the GOP will do this time around. Among the most popular phrases in that legislation is something with these two words: "Repeal of." Again, if you are doing real tax reform, you are trying to repeal big chunks of the tax code, and that means taking away tax breaks from individuals and businesses. Do you repeal the deduction for interest on education loans? Repeal the credit for first-time home buyers? Do you limit charitable contributions? Here's just one little screenshot from that 2014 reform bill - change is coming.

4. Remember, it won't just be individuals. For businesses, they face the same issue with a tax reform bill. What deductions, exclusions, modifications, limits and more should be zapped from the tax code? Do you get rid of deductions for certain oil refineries? What about deductions for energy efficient commercial buildings? Wind tax credits, solar tax credits, special rules for oil and gas exploration, the timber industry, agriculture, high tech. The targets are almost endless - if you really want to simplify the tax code. The idea is simple - on one hand, the business tax rate goes down, and you get a simpler tax system. But that means a lot of different tax breaks could go down the tubes. Here's a sampling of what was in that 2014 GOP reform bill on the business side:

5. The lobbyist and lawmaker explosion begins November 1. I have been reporting on Congress for over 30 years. Holding the details of a major bill until the end never really goes down well, no matter which party is cobbling together a huge bill. In 1986, it took 13 months to go from a draft tax reform bill to a signing ceremony at the White House. Republicans want to do that in just seven weeks, with a break for Thanksgiving in between. There are a lot of industry groups wondering what the text of the tax bill will show. There are a lot of lawmakers wondering what the text will have in it. This is a big deal. And there won't be much time to explain the choices to people/lawmakers/industries that don't like what they are reading.

About the Author