Federal law requires states to have a Medicaid estate recovery program, but gives states leeway in administering it. Dayton Daily News reporting has revealed Ohio has one of the nation’s most aggressive programs, and is among a minority of states that put liens on recipients’ properties.

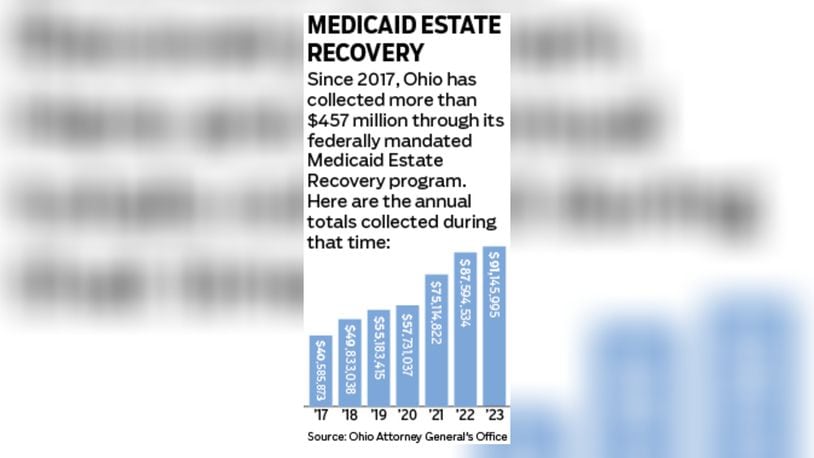

Ohio’s Medicaid estate recovery program has collected more than $457 million since 2017.

This story is free

We've opened this story as free to help you experience the important and entertaining journalism we're producing. Here are some ways you can follow our work:

- • READ: ‘I’m going to be homeless’: Ohio Medicaid collects $87.5M from families after loved ones’ death

- • READ: After Dayton man’s partner died, Ohio Medicaid came after his house

- • SIGN UP: Get the news of the day delivered to your inbox every morning with our free Morning Briefing newsletter.

- • SUBSCRIBE: Like what you see? Explore all special offers here

Federal legislation was introduced last month seeking to end the requirement for state Medicaid programs to seek repayment from dead recipients’ families.

The proposal by an Illinois congresswoman aims to “repeal the requirement that states establish” the program and “limit the circumstances in which a state may place a lien on a Medicaid beneficiary’s property.”

Illinois and Ohio are among the few states that have no cost-effective — or minimum — thresholds for pursuing Medicaid estate recovery, according to a 2021 study by the Medicaid and CHIP Payment and Access Commission (MACPAC), which reviews the health care program’s policies.

The bill by U.S. Rep. Jan Schakowsky, a Democrat, has been referred to the House Committee on Energy and Commerce. The proposal, called the Stop Unfair Medicaid Recoveries Act, has 13 co-sponsors ― all Democrats — but none from Ohio, Congressional records show.

How much support the bill has from House members representing area districts is uncertain.

Mike Turner, R-Dayton, “is a strong advocate for senior citizens and their families” and “looks forward to reviewing” the proposal, according to a spokesman from his office.

Several messages left with the offices of three others — Mike Carey, R-Columbus, Warren Davidson, R-Troy, and Greg Landsman, D-Cincinnati — were not returned.

Credit: STAFF

Credit: STAFF

‘A well-kept secret’

Estate recovery, which started in 1995, seeks to obtain repayment of the cost of benefits once a Medicaid recipient dies, according to the Ohio Department of Medicaid. Action is taken involving those who were either permanently institutionalized or age 55 years or older, according to state records.

Among the instances when recovery occurs is after the death of the Medicaid recipient’s surviving spouse and when the deceased recipients have no surviving children younger than 21, documents show.

Schakowsky said Medicaid recipients’ survivors are often unaware of the recovery program and states step in at a time when they are vulnerable.

“Imagine losing a loved one and putting them to rest, only to have Medicaid come knocking on your door demanding you now pay for the long-term care your departed relative received — an amount that has reached, in some cases, hundreds of thousands of dollars,” Schakowsky said in announcing the bill.

Since 2021, the mandate has “stripped 17,000 families in Illinois of their homes,” she added. “This practice is a well-kept secret with devastating and shocking consequences.”

Officials with the Ohio Attorney General’s Office, which administers the program, say while Ohio’s program places liens on properties, it does not foreclose on properties to collect on those liens.

“Funds are recovered out of the sale of homes, but we do not take possession of a property,” Ohio AG press secretary Steve Irwin has said.

The AG’s office says it is unable to say how many liens it has placed on Ohio properties.

The estate recovery program “falls on those with modest means, and may disproportionally affect people of color and perpetuate intergenerational poverty,” MACPAC said in its study.

The commission has recommended making estate recovery “optional for the populations and services for which it is required under current law.”

About the Author